Channel Kindness toward yourself this new year by learning how to build solid credit. Learning to build solid credit isn’t just about money—it’s an act of self-kindness and a step toward reducing financial stress. According to Born This Way Foundation’s research, over one-third of young people report their own personal or family finances as being a major source of stress. One way you can start your New Year off with kindness is by setting your own financial resolutions to alleviate some of this stress.

Let’s navigate the world of credit together with these simple 3 steps:

1) Learn the basics:

- What even is a credit score? Your credit score is a number that shows how trustworthy you are to borrow money and pay it back on time.

- You build your credit score with a credit card, which lets you borrow money to buy things. (Remember, it’s not your money and you have to pay it back later, so it’s super important to use it wisely!)

- Credit score ranges generally fall between 300 and 850. The higher your score, the better your credit. Keep in mind that your credit score can always improve, so if it’s not where you want it to be right now, that’s OK! Read on to learn how you can build it!

2) Build your credit:

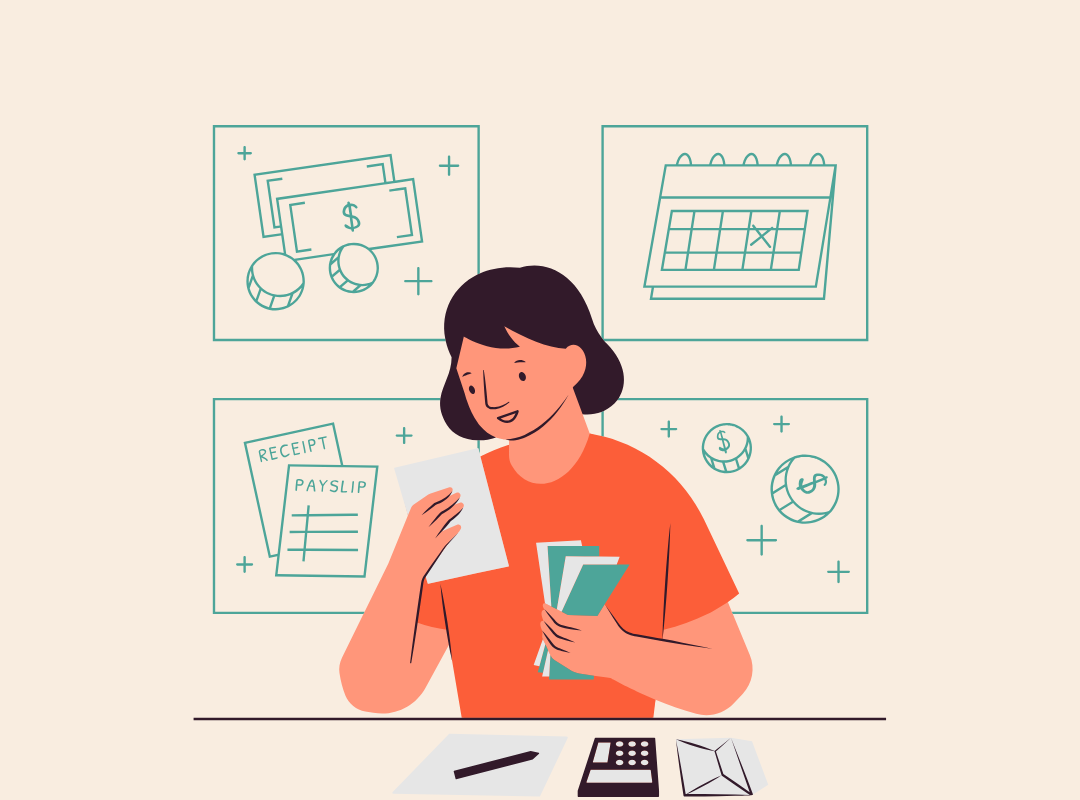

- Create a budget to understand where your money goes every month. That can help you set aside credit card payments before you start spending each month.

- Keep balances low and try to stay under your credit limit.

- When you use credit regularly and responsibly, you’re helping to build a positive credit history.

- Try to make payments on time.

3) Give yourself “credit”:

- Know that building credit takes time, so remember to be patient and gentle with yourself. You’re doing the best you can!

- By actively building and maintaining your credit, you are taking steps to reduce your financial stress and support your mental wellbeing!

- Knowledge is a powerful tool for reducing anxiety and fostering a good relationship with money. You’re showing kindness to yourself and your mental health just by learning!

*This article was created with support from our partners at Experian. To continue your financial wellness journey, visit https://www.experian.com/blogs/ask-experian/.